Process > Outcome

Build Your System. Journal Before & During. Get Coached After.

Know your pre-market baseline, capture your trading reality with voice or text,

and get personalized AI coaching that understands your complete context.

Now importing:

MetaTrader 5,

ProjectX,

The Futures Desk,

cTrader, and

Rithmic CSV files —

more coming soon.

Using a different platform? Tell us and we'll prioritize it.

🤖 AI Trading Coach (NEW in v2.0.0)

Your 24/7 Personal Coach Available on Trades & Journal Entries

Real-Time Coaching

Streaming conversations with context-aware responses

Personal Insights

Analyzes your specific trades and journal entries

24/7 Available

$0 vs $100-500/hour human coaching

Ready to Transform Your Trading Process?

Join traders who've discovered the power of systematic self-improvement

“This is a very promising development. By linking AI to trading journals, we can identify patterns in our trading and in our trading psychology that account for profitability and loss—”

BS

BS

Dr Brett Steenbarger

@steenbab · Apr 24 2025

I agree with my friend @steenbab. This looks very promising. Developing traders could benefit from more structure and focusing more on process than outcomes. I like the AI overlay to really help hone in on one's process.

Most trading journals track outcomes.

This one trains your process.

- Structured journaling

- AI-powered insights

AM

AM

Andrew Menaker, PhD

@Andrew_Menaker

See Your AI Coach In Action

Watch traders ask their coach about specific trades, emotional patterns, and decision-making. Real conversations. Real insights.

Complete Platform Walkthrough

Watch how Process > Outcome works — full walkthrough in under 6 minutes.

How to Journal: Plan & Preparation

Step-by-step journaling walkthrough: routines, hard rules, values, pre-market prep, notes, and review.

Traders don’t fail because of bad ideas — they fail from lack of structure.

A strategy might tell you when to enter. But it’s your

system that brings clarity — before, during, and after every trade.

A system is not a set of fixed rules — it’s a repeatable process that helps you

prepare, execute, adapt, and improve.

System ≠ Strategy

- A strategy is a component — an entry pattern or idea.

- A system is the full process: planning, journaling, execution rules, review routines, and mental preparation.

- Your system is what builds consistency — regardless of which strategy you trade.

Concept inspired by Brian McAboy, the "Consistency Coach" at InsideOutTrading.com

“An average or even mediocre strategy executed consistently, will outperform and make more money than a GREAT strategy executed inconsistently.”

— Brian McAboy, InsideOutTrading.com

Build Your System. Log Your Reality. Get Coached.

1️⃣ Build Your System

Define what works for YOU: pre-market routines, hard rules, and core values. Your system isn't generic—it's YOUR repeatable process that builds discipline.

- • Pre-market routines (your ritual)

- • Hard rules (entries, risk, exits)

- • Core values (discipline, patience)

- • Your personal trading framework

2️⃣ Log Your Reality

BEFORE market: Fill pre-market section → AI shows correlations

DURING session: Type or 🎤 voice notes → AI detects mood

AFTER trading: Complete review + log trades → AI links everything

- "Sleep <6hrs → -23% win rate"

- • Pre-market baseline analysis

- • Voice transcription 🎤

- • Real-time mood detection

- • Complete context linking

3️⃣ Get Coached

After your journal is complete, ask your AI coach about specific trades or your full session. The coach knows your rules, values, pre-market state, notes, and trades.

- "Why did I panic exit?"

- • Context-aware conversations

- • Streaming responses

- • Full conversation history

- • Available 24/7 ($0 vs $100-500/hr)

Where You'll Find AI in Process Trader

AI isn't just a feature—it's woven throughout your entire trading workflow

Pre-Market Analysis

BEFORE you trade: After filling pre-market section (sleep, stress, caffeine)

AI compares to your last 20 entries and surfaces patterns like: "Sleep <6hrs → -23% win rate"

Mood Detection

DURING session: As you write notes or use voice 🎤

AI detects emotional patterns in real-time (frustrated, confident, anxious) and links to trade outcomes

AI Coach

AFTER journal complete: Ask about trades or sessions

AI knows your pre-market state + notes + trades + rules. Streaming responses, full history, 24/7

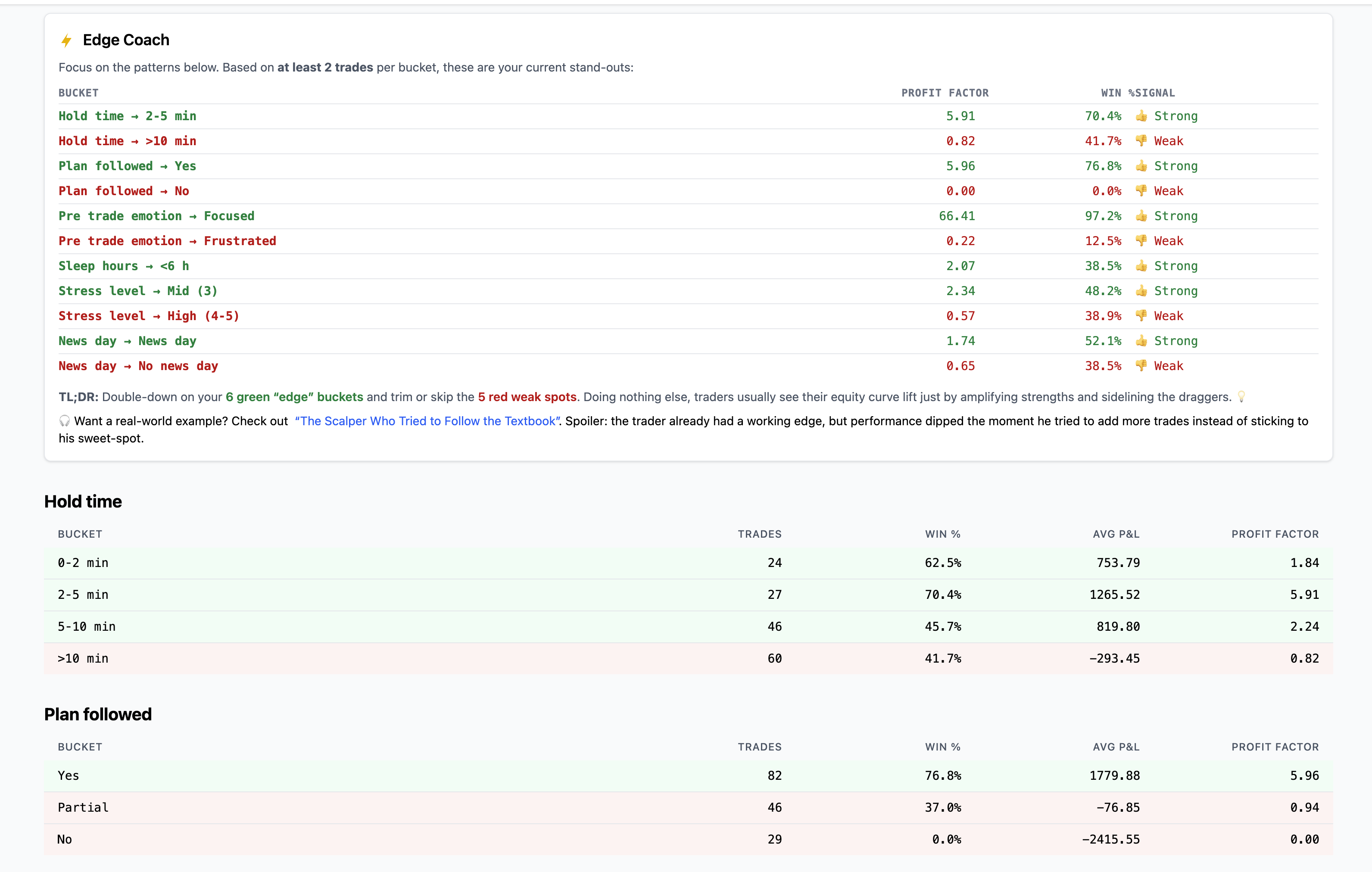

Edge Finder

Automated analysis: Deep dive into your performance

Which time blocks & moods actually make you money. AI finds your edge so you exploit it

Daily Reports

Overnight summaries: Every morning insights

Performance snapshot + focus areas for next session. Auto-delivered via email

Process Impact

Dollar quantification: What's your discipline worth?

Gamifies consistency. Shows $ value of following your system vs breaking rules

AI-Powered Reports — Your Offline Coach

Logging data is only half the battle. Our GPT-powered engine works overnight to turn your journal entries into razor-sharp insights. From daily reviews to quarterly deep dives — this is your AI-driven mirror for reflection and improvement.

Daily Trade Review

Delivered every morning at 2:00 AM, analyzing yesterday's session. Get a quick scorecard, spot anomalies or rule-breaks, and receive a single focus drill to sharpen tomorrow's process.

Runs Tue–Sat (covering Mon–Fri trades)

Weekly Trade Digest

Every Saturday at 8:00 AM, delivering a full breakdown: win rate, average P&L, duration, and which process metrics reliably predict winners. Plus outliers and focused drills for next week.

Complete statistical analysis of your trading week

Monthly Strategy Session

On the 1st of each month, reviewing the prior calendar month: total trades, process trends, edge durability, and behavioral heat-maps. Get three key trends and two high-leverage adjustments.

Strategic review and quarterly planning insights

Offline analysis meets online accountability — all reports auto-delivered via email, so you spend less time hunting data and more time acting on insights.

Transform raw journal data into clear trends, objective correlations, and a personalized improvement roadmap.

Advanced Analytics Suite

Transform raw trading data into actionable insights. Our analytics tools reveal patterns, quantify the value of discipline, and help you optimize what's working.

Edge Finder — Know Exactly Where You Win

Most journals drown you in stats. Edge Finder surfaces only what matters: which time blocks, hold-times, and mind-sets actually put money in your pocket. Green means "exploit", red means "trim".

Slice your edge by symbol, month, or tag without touching a spreadsheet.

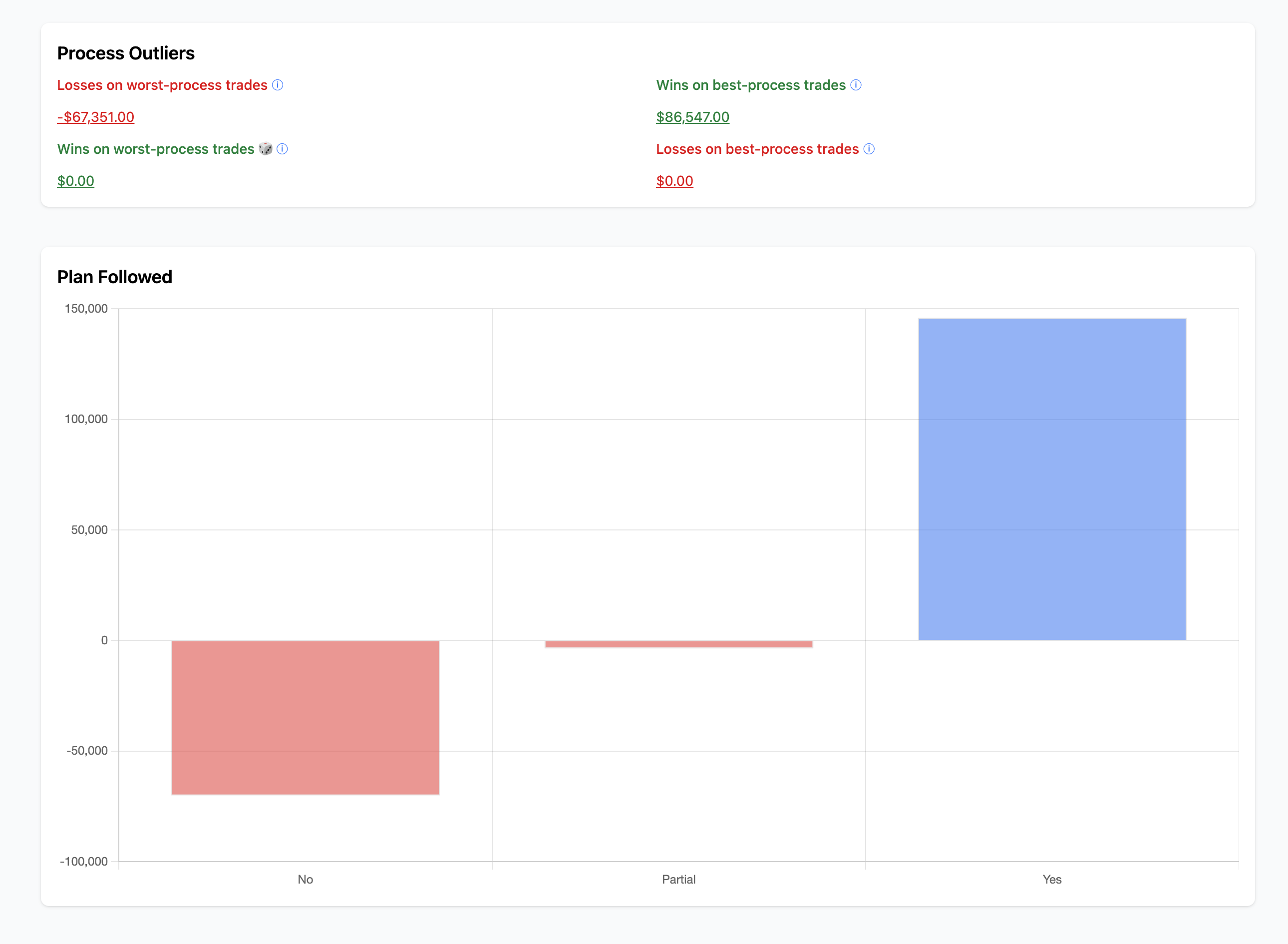

Process Impact — $-Value of Your Discipline

Ever wondered what skipping a plan or trading while frustrated really costs? Our Process Impact dashboard converts behaviour into dollars. See the P & L swing when you follow the plan vs. when you don’t, or how “FOMO” days compare with “Calm” sessions.

Losses on worst-process trades, wins on best-process trades — all tallied so you can quantify the ROI of discipline.

Ready to Discover Your Trading Edge?

Join traders using data-driven insights to improve their performance

Monte Carlo Analytics — Stress‑Test Your Edge

Run thousands of simulations on your actual trades to estimate drawdown, risk of ruin, and the $‑value of discipline.

📊 Missed Trade Analytics — Learn From What You Didn't Take

The most expensive trades aren't the ones you lose money on — they're the profitable ones you didn't take. Turn "what if" regret into actionable insights.

Spot Costly Patterns

Identify when hesitation or fear costs you profitable trades

Validate Smart Skips

Confirm when discipline saved you from losses

AI-Powered Insights

Get missed trade analysis in your daily and weekly reports

"Every missed trade tells a story. Some celebrate discipline — others reveal expensive blind spots."

Transform Your Trading Today

Join traders who've discovered the power of systematic improvement. Start building your edge with our comprehensive analytics and AI-powered insights.

Stay Updated with Latest Features

Follow us on @tradetofer for release notes & trading-psychology insights.

Financial Disclaimer: The information and tools offered by Process & Outcome are for educational and informational purposes only and do not constitute financial or investment advice. Trading carries significant risk, including loss of principal. Past performance does not guarantee future results.

You are solely responsible for your investment decisions. Consider your personal financial situation and consult a qualified investment professional before acting. Process & Outcome and its team accept no liability for any losses you may incur.